The upgrade will improve energy security for Fortis’s customers, and the BCUC has confirmed the need for a natural gas system for decades to come.

Introduction

FortisBC Energy Inc. (FEI) is BC’s largest natural gas distribution utility, serving 1.1 million customers in the Lower Mainland, Vancouver Island and the Interior.

On October 27, 2025, the BC Utilities Commission (BCUC) approved an application from FEI to upgrade its liquified natural gas (LNG) storage facilities at Tilbury in Delta, BC.

This may come as a surprise to some readers, since in 2023 the BCUC rejected FEI’s request to upgrade its Okanagan pipeline.

Let’s compare these decisions.

Current facilities

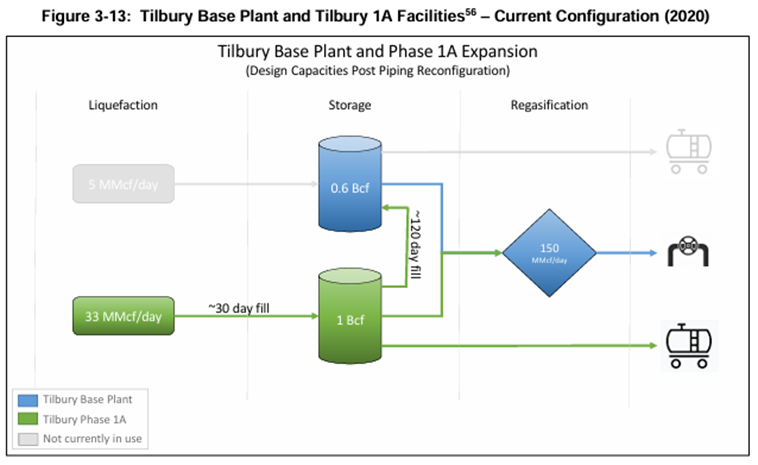

There are two storage tanks at Tilbury serving BC customers today: a 0.6 billion cubic feet (BCF) Base Plant that is used to meet peak natural gas demand in winter, and another tank that serves LNG sales.

The Base Plant stores about 0.7 days’ gas reserve for Lower Mainland in the event of a pipeline outage. But if that outage happened at the winter peak, Fortis would have to convert (“regasify”) the LNG to natural gas at almost five times the rate possible at the current facility.

In contrast, FEI’s Mt. Hayes storage facility holds 10 days’ gas reserve for Vancouver Island and can regasify the LNG fast enough to serve 100 percent of the Island’s daily needs.

By the way, construction of the Tilbury “Phase 1A” facility was approved by a previous government in 2013, bypassing the BCUC’s review process. The same government order required the BCUC to allow Fortis to collect the cost of Phase 1A from all gas ratepayers.

Interference with the BCUC’s independence is nothing new, even if the current government is taking it to a whole new level.

Problems to be solved

The new LNG storage facilities solve two problems with the Base Plant:

- The 53-year-old storage tank, which FEI relies on for meeting peak demand on the coldest days, has reached the end of its useful life; and

- There is insufficient storage and regasification capacity to supply gas to the Lower Mainland in the event of an outage of the Enbridge T-South pipeline that brings gas from the northeast of the province.

FEI states that a “no-flow event” on the T-South pipeline in the winter is “by far, FEI’s single largest customer outage risk.” As I explained before, this is not a purely theoretical risk – an explosion shut the pipeline in October 2018, and Vancouver came close to running out of gas.

This would not be good. We rely heavily on gas for building heat; there are health and safety risks to losing supply in the winter, and institutions such as hospitals have limited backup. While the economic effects were disputed, FEI provided expert evidence that an outage on the T-South pipeline in an average winter could cause the Lower Mainland’s economy to lose up to $3.8 billion in GDP.

Even assuming that gas is still flowing on the T-South pipeline, there is now another issue. To meet its winter peak, FEI relies on importing gas from the US, where it has storage arrangements. The current trade instability with our southern neighbour introduces new uncertainty over the security of that supply.

The solution

The BCUC agreed that Tilbury should be upgraded, and approved FEI’s recommended alternative. This means FEI will now build:

- A 3 BCF LNG storage tank to replace the old 0.6 BCF version; and

- A regasification facility capable of releasing 800 MMCF of gas per day, roughly the rate required to serve the Lower Mainland on a winter day.

The new tank will store 1 BCF of LNG to serve peak demand in the Lower Mainland. FEI argued that this allocation, almost twice the capacity of the current tank, was justified due to the increase in gas demand since the latter went into service in 1971.

The remaining 2 BCF of LNG will be held in reserve in the event of a major outage. This, combined with the upgraded 800 MMCF per day regasification, could support the Lower Mainland for “at least three days” during the winter in the event of a pipeline outage.

The project will cost $873.4 million in 2023 dollars, and will increase FEI’s gas delivery rate by a cumulative 11.03 percent by 2031 relative to 2024. The levelized rate impact over the life of the assets will be 2.45 percent.

That said, the extra 2 BCF of storage for resiliency only cost $250 million more than a 1 BCF replacement tank would have done – a relative bargain.

Ratepayer protection

The Tilbury upgrade project is being paid for by FEI’s ratepayers. To ensure they get their full value for money, the BCUC imposed a condition on FEI that the ratepayer-funded facilities may not be used “for LNG transportation service customers, export or other related purposes unless otherwise approved by the BCUC.”

This was an astute move. FEI quite properly buys a surplus of some critical inputs such as pipeline capacity or storage, then sells the excess if it’s not needed and returns money to ratepayers. If the Tilbury assets were to be used for other, non-regulated purposes, the BCUC would want to be sure ratepayers are properly compensated.

Stranded assets?

The Tilbury upgrade has an estimated 60-year life. After 7 years’ construction, it could still be in service into the 2090s. The BCUC examined whether it will still be needed by then, or whether it would become a “stranded asset.”

The BCUC concluded that the Tilbury facility “will continue to be useful for peaking and/or resiliency purposes in a situation where gas demand declines significantly in the long-term.” In addition, it noted that FEI could find other uses for the facilities, if necessary, such as rebalancing its sources of gas supply to take advantage of more local storage.

Contrast to the Okanagan

While the BCUC acknowledged that forecasts of future demand for natural gas are inherently uncertain, it accepted that the Tilbury assets will be in use well into the future, long after the 2050 date for Canada achieving net zero carbon emissions, for example. This is quite different to the BCUC’s position two years ago when it rejected FEI’s request to upgrade a gas pipeline to meet growing winter peak demand in the Okanagan.

In that decision, the BCUC acknowledged an “imminent capacity shortfall”, but said the $327.4 million cost was “very significant” and there needed to be greater certainty that the pipeline was “fully required”. The BCUC was particularly concerned that demand for natural gas might peak after 2030, when the provincial building code appears to preclude its use in new buildings.

And therein lies the difference. The Tilbury facilities provide resiliency benefits to FEI’s customers all year round and for as long as the gas system is in use, even if demand declines. The Okanagan pipeline upgrade would only have served customers at peak times, and would cease to be necessary if peak demand eventually declines. This isn’t a case of favouring the Lower Mainland over the Okanagan; it’s a difference in the cost-benefit equation.

I still maintain that rejecting the Okanagan pipeline upgrade was a poor decision, but I agree the risk of it being stranded was higher than that of the Tilbury assets.

Conclusion

The Tilbury decision is good news for FEI’s ratepayers, despite the increase in the delivery rate. The risk of not being able to serve winter peak demand or respond to a pipeline outage is considerably reduced.

More broadly, it’s good to see the BCUC taking a long-term view of BC’s natural gas system. Growth in demand may slow as a result of government environmental policies, but replacing natural gas will take many decades. The government has no credible plan for fully electrifying building heat; in fact, it is now proposing to ration power to growth sectors of the economy such as data centres because BC Hydro doesn’t have enough electricity to go around.

In the meantime, the BCUC is right to enable utilities like FEI to invest in a reliable and resilient natural gas system.