Operating expense increases will likely cause rates to rise after the government-imposed rate cap expires. It shows the folly of the BCUC abandoning its plan to impose some fiscal discipline on the utility.

Introduction

BC Hydro just released its second quarter results for fiscal 2026 (F2026), the financial year ending March 31, 2026. There was no fanfare accompanying the release, it simply appeared on the utility’s website last Sunday afternoon.

There’s some good news, but on the whole, things are just a bit less bad than before.

First the good news

BC Hydro’s loss for the first half of the year reduced to $149 million from $199 million in the same period last year, thanks to revenues increasing slightly faster than expenses. I’d call that good news.

Domestic sales

Domestic sales in gigawatt hours (GWh) increased 2.9 percent compared to the first half of last year. This has its benefits – more sales means BC Hydro’s fixed costs will be shared more widely, reducing rates.

Despite this, BC Hydro’s sales to residential customers actually fell by 1.4 percent in the last six months compared to the same period last year. Perhaps the summer was cooler this year, and air conditioning demand was down, or maybe the demand from heat pumps and electric vehicles is not as strong as forecast.

Anyway, the overall growth of 2.9 percent isn’t necessarily all good news. In its latest Integrated Resource Plan, BC Hydro’s Reference (or “most likely”) forecast is for average growth of just 1.4 percent per year. Even with that modest growth, it will have an energy deficit by F2031, and that includes the new generation from the 2024 Call for Power.

But more worryingly, the Plan’s high-load forecast is for 1.8 percent average growth, with an energy deficit by F2029 or before (the plan doesn’t disclose the forecast load balances for years prior to F2029). If the 2.9 percent increase in the latest half-year results is the beginning of a trend, we’ll be running out of electricity a lot earlier than F2031.

The report’s section on “management’s discussion and analysis” neither discusses nor analyses this phenomenon. Surely growth that is fifty percent higher than BC Hydro’s forecast for “high load” hasn’t escaped their notice?

Other sales

In addition to the familiar categories of residential, commercial and industrial customers, BC Hydro’s domestic sales also includes a subset called “other sales.” Apparently, this includes irrigation and streetlighting, sales to other BC distributors (City of New Westminster and FortisBC Inc.), and, oddly, exports to Seattle City Light and Hyder, Alaska (how are these sales “domestic”?).

It would be helpful to know just how big the exports to Seattle and Hyder are. Domestic sales would only have increased 0.7 percent if we exclude the “other sales” category, which is very different from the headline number of 2.9 percent. I suspect these exports are relatively small, but it would be good to know for sure.

Domestic revenues

Domestic revenues grew 5.1 percent compared to the first half last year, as a result of the growth in sales and BC Hydro’s prices increasing.

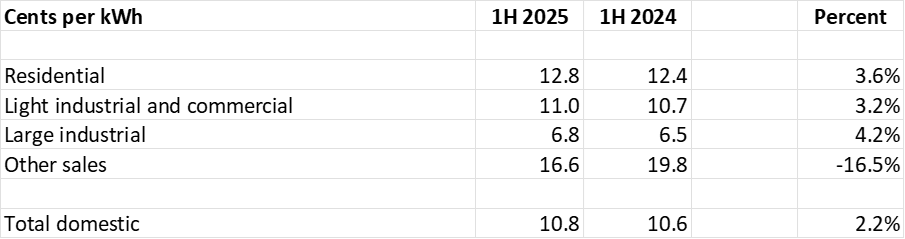

The report noted the “average customer rate increases” of 3.75 percent, but the picture is a bit more nuanced than that. In fact, BC Hydro’s domestic revenues per kilowatt hour (kWh) rose by only 2.2 percent from the first half of 2024:

Residential customers’ cost per kWh increased 3.6 percent, compared to consumer price inflation in BC in September 2025 of 1.9 percent from the year before. But those lucky “other sales” customers on average paid more than 16 percent less. I have no doubt there’s a good reason for this, but it isn’t in the report.

Trade revenues

BC Hydro relies heavily on profits from Powerex, its unregulated energy trading subsidiary, to subsidize electricity rates in the province. BC Hydro doesn’t release these “trade income” figures quarterly, but there are indications where they might be going.

In F2025, the last year its rates were set by the BCUC, BC Hydro built in a subsidy of $224 million from Powerex. But in F2026 and F2027, when the utility’s rates were set by government, this subsidy increased to $547 million per year.

Powerex is certainly capable of achieving this figure – trade income in F2025 was $628 million, after all. But BC Hydro’s trade revenues are down slightly (2 percent) in the first half of this year compared to last, despite trade volumes increasing by 4 percent, indicating lower trading prices. Also, water inflows to BC Hydro’s reservoirs are still below their historical average, thanks to the below-average snowpack in spring 2025, which may impede Powerex’s ability to trade surplus energy.

If trade income turns out to be less than $547 million by the end of the year, ratepayers will be on the hook for the difference.

Now for the bad news

BC Hydro’s biggest fiscal problem is that its operating expenses are accelerating, seemingly out of control. This is likely to cause significant rate rises once the government-imposed increases, 3.75 percent for each of the next two years, expire.

BC Hydro’s cost of energy is still being affected by the ongoing drought. While the picture is getting better, we still imported 2,041 gigawatt hours in the last six months, the equivalent of half a year’s generation from Site C. As a result, BC Hydro overspent on imports by $110 million, which ratepayers will have to pay back in future.

In the first half of this fiscal year, personnel costs rose 7.4 percent compared to the same period last year, and materials and external services rose 8.1 percent. These are all costs over which BC Hydro management has direct control.

BC Hydro’s depreciation of plant, property and equipment increased by a whopping 22.3 percent, largely due to the Site C dam going into service. The $16 billion project cost nearly double its budget, and the effects of that overspending are now showing up. The overspending is baked into rates for decades to come, making it all the more important to manage the operating costs.

These increases are not just one-off events, as an analysis of operating expenses for the last few years shows:

(In the chart above, the F2026 figures are the annualized half-year figures)

BC Hydro’s management really does need to get its operating expenses under control. And that includes managing its ten-year, $36 billion capital program. Even if these new projects come in on budget, depreciation will continue to rise.

Conclusion

It would be wrong to read too much into any one set of financial results, especially quarterly results, given the seasonality of BC Hydro’s business.

That said, there are some warning signs for the rest of the year, and a continuing trend of increasing operating expenses, both of which could cause rates to be higher when the government-set rates expire in 18 months. Alternatively, the government could be motivated to artificially supress rate increases again, which has not ended well in the past.

It’s a real shame the BCUC abandoned its plan to impose performance-based rates for BC Hydro. It could have provided the incentives BC Hydro sorely needs to get its operating expenses under control.

FortisBC Energy Inc., for example, must reduce its operating expenses by a 0.55 percent “productivity factor” in each of 2025 and 2026, after allowing for inflation. And the BCUC just imposed a 2 percent cap on increases of Pacific Northern Gas’s operating expenses.

Yet BC Hydro seems to have a free hand with its spending. The BCUC appears to be okay with imposing performance-based rates on other utilities, why not for BC Hydro?