The utility is looking to collect unbilled expenditures that kept rates lower in previous years.

Introduction

In April this year, the BC Utilities Commission (BCUC) approved an increase to the delivery charges for customers of Pacific Northern Gas’s western division (PNG-West). This is the second increase for 2025, and means delivery charges have increased by a total of 27.8 percent since last year.

Delivery charges make up around 90 percent of PNG-West customers’ bills, and pay for operations and maintenance costs, amortization of existing assets, and profit. The remaining 10 percent of bills is the cost of the natural gas (including any storage and transportation costs).

The 2025 increases are interim, pending the BCUC’s review of PNG-West’s rates application. Unsurprisingly, the proceeding has generated a large number of letters of comment (60 at last count), none of them in favour of the increase. Some go so far as to accuse PNG-West of “gouging” customers and wanting to “increase their profits.”

Are these criticisms fair?

Background

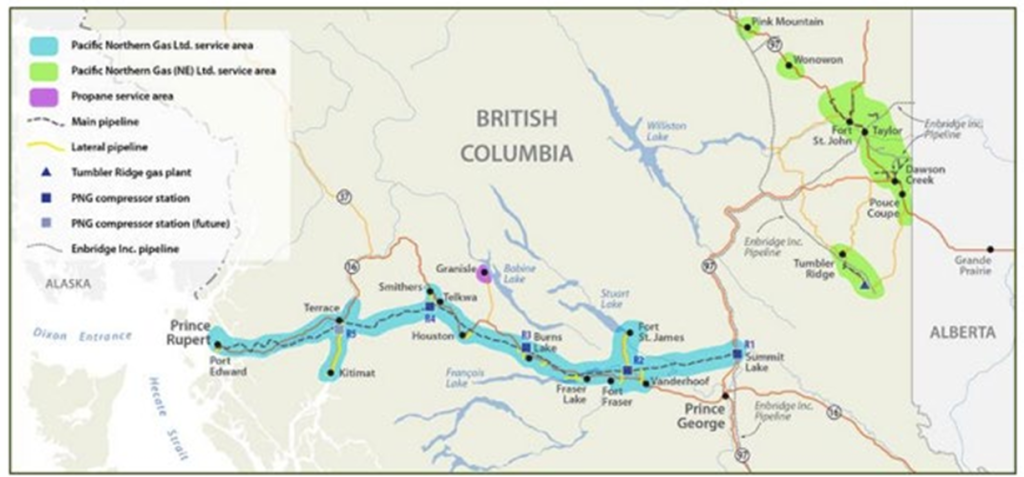

PNG-West serves around 20,700 customers in northwestern BC, including Terrace, Kitimat and Prince Rupert (it also has a subsidiary, PNG (NE), that serves another 21,700 customers in northeastern BC).

While PNG is the second largest gas utility in BC, it is considerably smaller than FortisBC Energy Inc. (FEI), which serves just over one million customers in the south of the province and on Vancouver Island.

2025 cost increases

PNG-West says that it requires $90.9 million in revenue from its customers in 2025, compared to $58.4 million in 2024, even though its operations and other costs have only gone up $0.7 million since last year. Why does it need so much more money in 2025?

To start with, there’s an additional $4 million for PNG-West’s return on equity, the profit it is allowed to earn. But the return on equity isn’t up for debate in this proceeding, as the decision has already been made; in November 2024 the BCUC increased the allowed returns for almost all BC utilities. PNG-West’s allowed return increased from 9.5% to 10.4%.

To say that PNG-West is “gouging” customers is probably unfair. There is no markup on the cost of the natural gas PNG-West delivers, nor on its operations expenditures. The only profit included in rates is a return to shareholders for the capital they have provided, which ultimately allows the utility to attract more capital for future projects.

It doesn’t help that PNG-West has the highest return on equity of any utility regulated by the BCUC, but this reflects its status as what PNG-West itself describes as “the riskiest utility in Canada.”

Playing catch-up

Looking beyond the return on equity, PNG-West is seeking to recover other expenditures that have previously been approved by the BCUC. For example:

- When the BCUC increased the allowed return on equity, it backdated the increase to 2024, so there’s an additional $4 million to collect for that year too.

- There’s $5.2 million in revenue lost from forestry customers in 2023 and 2024 because of forestry shutdowns, bankruptcies etc. The BCUC approved this carry-forward of revenue losses to reduce the risk to PNG-West once it had become apparent that the revenues would be lower than forecast.

- And there’s $3 million that was spent up to the end of 2024 to repair “pipeline defects” (PNG is currently under an order from the BC Energy Regulator limiting the gas pressures it can use in its pipelines for safety reasons). The BCUC allowed PNG-West to defer these costs, rather than have them increase rates in previous years.

All of these items appear reasonable enough, even if they don’t relate to 2025 expenditures. And there’s a good argument for collecting them as soon as possible; the longer they remain uncollected, the larger the interest payment ratepayers will face.

PNG-West has done several things in the last few years to address what it calls “unusual circumstances.” Costs such as the $3 million in pipeline repairs have been deferred, and windfall gains have been used up, all to keep rates as low as possible in the Micawber-like anticipation of new revenues from large industrial customers. Sadly these “did not materialize” and now the bills are coming due.

This may be the single biggest reason the 2025 rate increase looks so large. The 2024 revenue requirement was kept artificially low with a $14.1 million windfall PNG-West had received as a result of a potential new customer cancelling its service. Without that, the 2024 rate increase of 11.5 percent would have been 42.6 percent.

Smoothing out the increases

PNG-West says its rates should rise by 50.6 percent in 2025 to cover its full revenue requirement, but it has recognized the challenge this poses to its customers and has proposed smoothing the increase over two years. It is also proposing to use the remaining $5.7 million from the same windfall it used to lower rates in 2024, but by the end of 2025 that particular cupboard will be bare.

With these changes, PNG-West’s residential rates would rise by “only” 27.8 percent in both 2025 and 2026, and by 5 percent in 2027. That’s still pretty steep, but taking into account the abolition of the carbon tax in April 2025, the increases in residential customers’ bills will not be quite so bad, as the table below shows:

| % | 2025 | 2026 | 2027 |

| Unsmoothed rate increases | 50.6 | 1.1 | 4.6 |

| Smoothed rate increases | 27.8 | 27.8 | 5.0 |

| Total bill increases after smoothing | 12.7 | 16.7 | 3.5 |

The resulting bill increases in 2025 and 2026 are still larger than the 10 percent threshold that the BCUC usually considers “rate shock.” The regulator could direct PNG-West to smooth the rates over a longer period – three years rather than two would mean smoothed rate increases of 23.3 percent in each of the three years, and correspondingly lower bill increases in the first two years.

The BCUC just today asked PNG-West what the effect of a 5 or 10-year smoothing period would be. Does this reflect the BCUC’s current thinking? If so, it should be cautious. The whopping 50.6 percent rate increase in 2025 is in large part a result of failed attempts to smooth out previous cost increases. The outlook for the next 10 years is very uncertain; the BCUC might be wise to allow PNG-West to finish the current smoothing exercise more quickly before something else goes wrong.

Conclusion

PNG-West has described its proposed rate increases as a “reset” that will set it up for more stable requests in future. It has certainly faced some serious challenges in recent years, and its ratepayers would undoubtedly appreciate some stability.

These proposed rate increases seem just and reasonable, if not exactly pleasant. However, thanks to a combination of PNG-West’s geography and customer demographics and the BC government’s CleanBC policies, I fear that PNG-West’s future may be anything but stable. In a subsequent article I’ll address the utility’s long-term challenges, and what might be done about them.