Natural gas is a naturally occurring, methane-rich gas extracted from the ground and used as a fuel for building heat, industrial processes, transportation and electricity generation. Natural gas is known as a “fossil fuel” as it was formed eons ago from the remains of living organisms.

Production and shipping

BC has large quantities of natural in fields in the northeast of the province. According to the BC Energy Regulator (BCER), reserves (known quantities of commercially recoverable gas) in 2024 increased 8.4 percent in 2024 to 99.6 trillion cubic feet (Tcf). 96 percent of the gas reserves are in the Montney field.

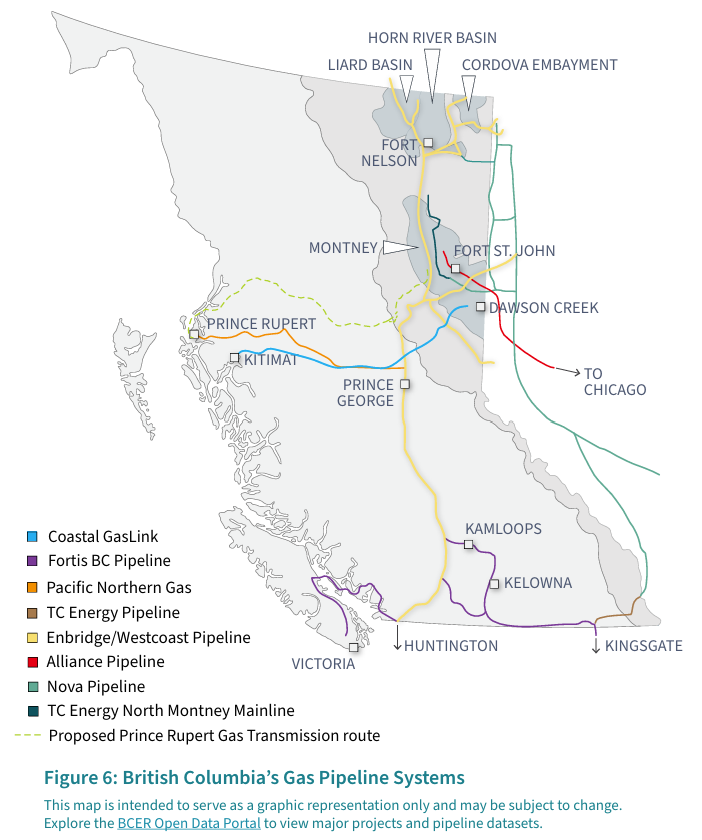

Natural gas is usually shipped from northeastern BC by pipeline. It is shipped via the Enbridge pipeline to markets in southern BC and the northwestern US, and the Coastal GasLink pipeline takes it to Kitimat to be exported as liquified natural gas (LNG).

Source: BC Energy Regulator website.

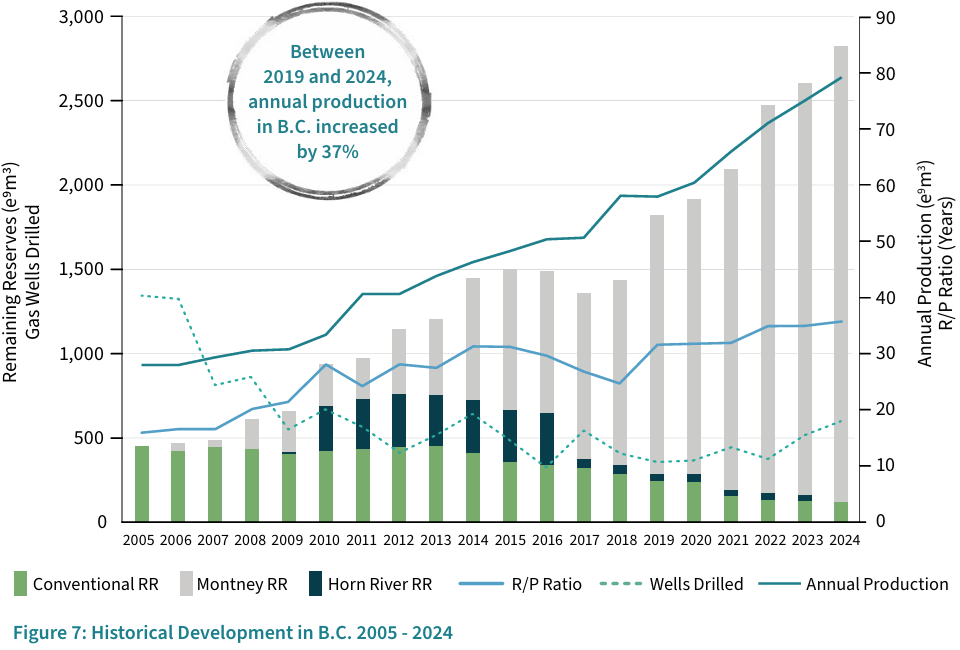

Production of gas in BC has grown considerably since 2005:

Source: BC Energy Regulator website.

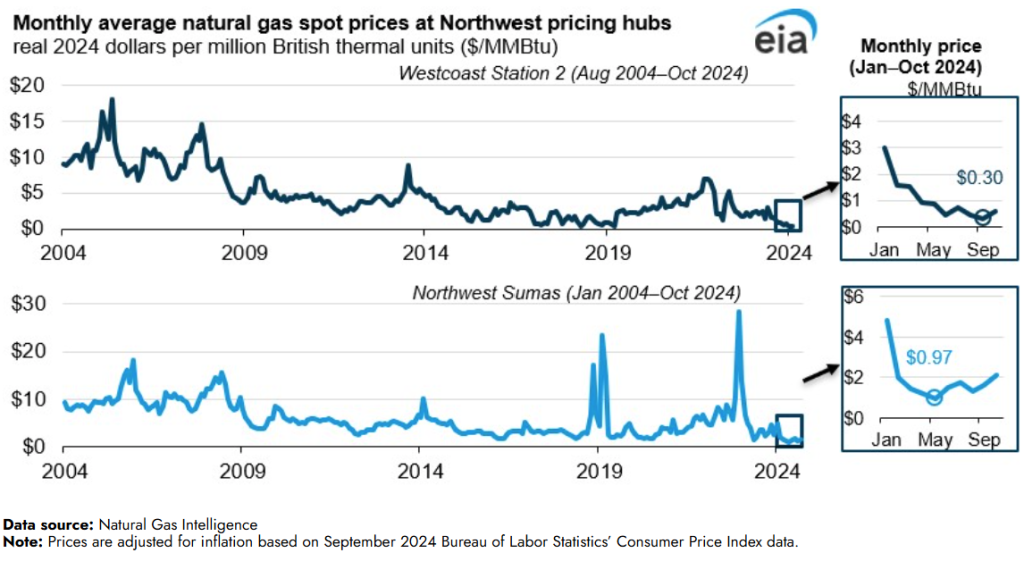

Price of natural gas

Natural gas prices were at historic lows in 2024:

Use of natural gas

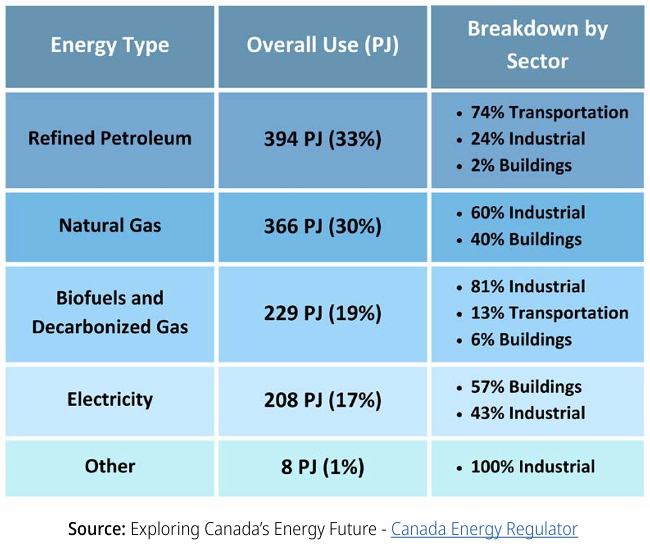

According to a BC government report, natural gas constituted 30 percent of final energy demand in BC.

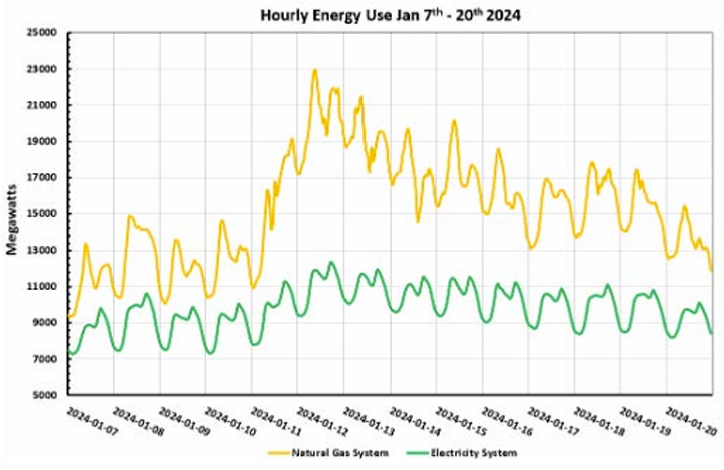

The same report shows that, in a January 2024 cold snap when energy demand was at its peak, natural gas provided around twice as much energy as electricity.

Distribution utilities

FortisBC Energy Inc. (FEI), the largest supplier of natural gas in BC, delivered 230,191,000 gigajoules (GJ) (230.2 petajoules) of natural gas to 1,093,663 customers in 2024, according to its annual report to the BCUC.

FEI estimates its average use per customer as follows:

- Residential customer: 60 GJ per year;

- Small commercial customer: 293 GJ per year;

- Large commercial customer: 3,253 GJ per year;

- Industrial (general firm service): 18,542 GJ per year.

Pacific Northern Gas (PNG) delivered 3,058 terajoules (TJ) (3.1 petajoules) of natural gas to its end-use customers in 2022, and an additional 1.9 petajoules to transportation customers, according to its annual report to the BCUC.

Environmental effects

Natural gas releases carbon dioxide, a greenhouse gas, when it is consumed for heating or other uses. For this reason, government policy is to either reduce the use of natural gas or to increase the supply of renewable natural gas, which is generally considered to have low or zero greenhouse gas effects when it is consumed.

Methane, the main constituent of natural gas, is also a greenhouse gas. MIT estimates that methane is 80 times more effective at trapping heat than carbon dioxide over 20 years, or 28 times over 100 years. Methane can be released unintentionally in the extraction, processing and transportation of natural gas (these are known as fugitive emissions).

Natural gas is sometimes referred to as “conventional natural gas” or “fossil gas” to distinguish it from renewable natural gas.

Legal definition

Legally, the BC government’s Carbon Tax Act defines natural gas as:

“natural gas, whether or not the natural gas (a)occurs naturally or results from processing, or (b)contains gas liquids, but does not include refinery gas”

and defines refinery gas as:

“gas for use in an oil refinery that is produced as a result of distillation, cracking, reforming or other oil refining processes.”

The BC government formerly levied the carbon tax on natural gas. Starting April 1, 2022, the carbon tax rate on natural gas was $0.0979 per cubic metre, or $2.50 per gigajoule, rising to $0.324 per cubic metre, or $8.26 per gigajoule, by April 1, 2030.