Why doesn’t the plan support the province’s climate goals? And where is the energy coming from for customers of the proposed North Coast Transmission Line?

Introduction

BC Hydro, the province’s largest electric utility, has filed its 2025 Integrated Resource Plan. Plans such as this are intended to ensure utilities anticipate the investments they must make to provide reliable energy over the long run.

At 413 pages, it has undergone an Ozempic-style transformation from the 2021 version (1,674 pages, with a 368-page update filed two years later), and is considerably easier to digest.

Despite its relative brevity, the Plan reveals quite a bit about the energy policies of BC Hydro’s owner, the provincial government.

The 20-year view of the utility’s future will be reviewed by the BC Utilities Commission (BCUC) in the coming months. Here’s a quick run-through of the highlights.

Note: this article was edited on November 26 to clarify the source of BC Hydro’s 2023 assumptions on building electrification.

Load forecast

The foundation of the resource plan is the load forecast: how much electricity the utility’s customers will need in future. Since no forecast will ever be exactly correct, BC Hydro has provided three scenarios in its May 2025 forecast, on which the Integrated Resource Plan is based:

- The Reference Scenario (most likely) (compound 1.4 percent annual growth in energy demand from F2025 to F2050);

- The High Load Scenario (1.8 percent annual growth); and

- The Low Load Scenario (0.5 percent annual growth).

BC Hydro also did a separate forecast of the energy requirements of LNG and mining companies in the North Coast region, over and above what’s in the Reference and High Load Scenarios. In other words, even if we only end up with the 1.4 percent annual growth anticipated in the Reference Load Forecast, BC Hydro might also have to meet additional demand from customers on the North Coast.

Reference Scenario

The Reference Load Forecast is to provide “reasonable accuracy over the near term (e.g. five years)” and is considered the most likely scenario in that timeframe (BC Hydro doesn’t consider any load forecast to be more or less likely over the long term).

The May 2025 Reference Load Forecast for energy has dropped slightly since the April 2023 version, reflecting lower anticipated economic growth in BC, especially lower industrial forestry load.

| Forecast vintage | Total Energy Demand in F2032 (GWh) | Total Energy Demand in F2042 (GWh) |

| December 2020 | 69,600 | n/a |

| April 2023 | 72,000 | 78,600 |

| May 2025 | 69,600 | 79,300 |

The May 2025 forecast only includes the limited ration of electricity for data centres and artificial intelligence businesses proposed by the government in Bill 31, and doesn’t include any energy at all for the LNG and mining companies that might use the new North Coast Transmission Line.

High Load Scenario

BC Hydro does describe a scenario where electricity demand grows a bit faster – the High Load Scenario. For example, this scenario assumes that we reach the legislated target of 90 percent electric vehicle sales by 2030, and projects 6,500 GWh (i.e. more than another Site C) of additional energy will be required by F2050 for vehicle charging.

But to meet the greenhouse gas emission reduction targets by 2050, far more electricity than that will be needed than is in the High Load Forecast.

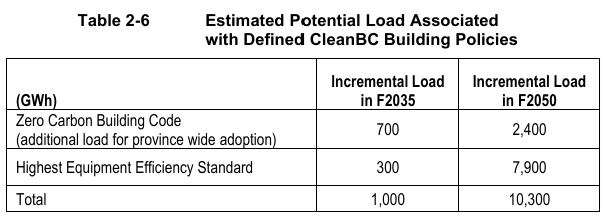

For example, BC Hydro provides an estimate of the additional energy required just to adopt the Zero Carbon Building Code for new buildings provide-wide and to implement the Highest Efficiency Equipment Standard for new sales of space and water heating equipment.

These are just some of the additional calls that will be made on electricity to meet the 2050 net-zero carbon target. And, like the electricity for the North Coast, they’re not in the High Load Forecast.

The High Load Forecast should show the highest demand BC Hydro could reasonably be expected to encounter, not just the highest demand it feels like serving. The BCUC should challenge this, for BC Hydro’s own sake as well as ours.

Changing climate

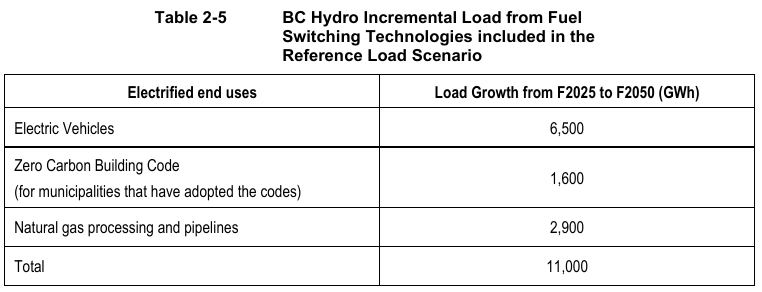

The Reference Load Forecast includes some additional energy for customers switching to electricity from other fuels:

However, BC Hydro seems to be skeptical of government climate policy, noting the “global and local changes to climate action” which have impacted load growth.

In 2023’s “accelerated electrification” scenario, BC Hydro assumed a widespread electrification of existing building space heating. This has been scaled back to an assumption that residential heat pumps and commercial electric space heating will only be chosen for “new construction in municipalities which have adopted zero carbon building codes” even in the highest demand scenario for 2025.

It’s a similar story with electric vehicles. The target in the province’s Zero-Emission Vehicles Act is that 90 percent of new vehicle sales will be zero emission by 2030; BC Hydro is now assuming that only 60 percent of new sales will be electric by then.

BC Hydro seems to share my view that the government’s climate targets are not credible. It says that its 2025 forecasts “do not reflect an assumption that the province will meet B.C.’s greenhouse gas emissions targets as defined in the Climate Change Accountability Act and the Clean Energy Act.” In other words, even BC Hydro thinks the province isn’t doing enough to meet its own targets.

It’ll be interesting to see how all these assumptions align with what BC Hydro describes as the “independent” review of the government’s CleanBC plan that is currently underway. Since the government owns BC Hydro, and undoubtedly owns this Plan too, is this a sign that the province’s climate ambitions are weakening?

Load balance

So much for the forecast, but where does that leave BC Hydro in terms of the three essential components of the electrical supply: energy, capacity and transmission?

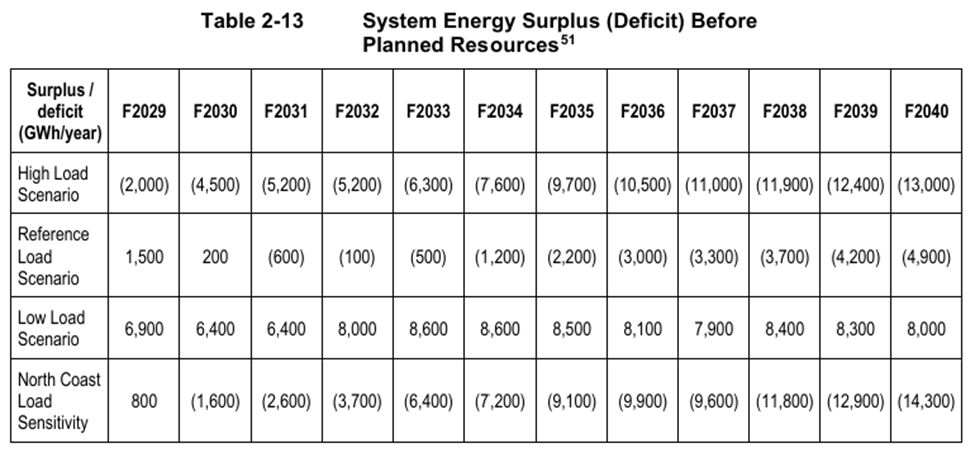

BC Hydro is still forecasting an annual energy deficit in its Reference Scenario, but this has dropped since the April 2023 estimates. In F2032 for instance, the deficit has dropped from 3,100 GWh to just 100 GWh. Still, the deficit by F2040 could be 4,900 GWh (equivalent to another Site C Dam); this could grow to as much as 13,000 GWh in the High Load Scenario or 14,300 GWh with more demand from the North Coast.

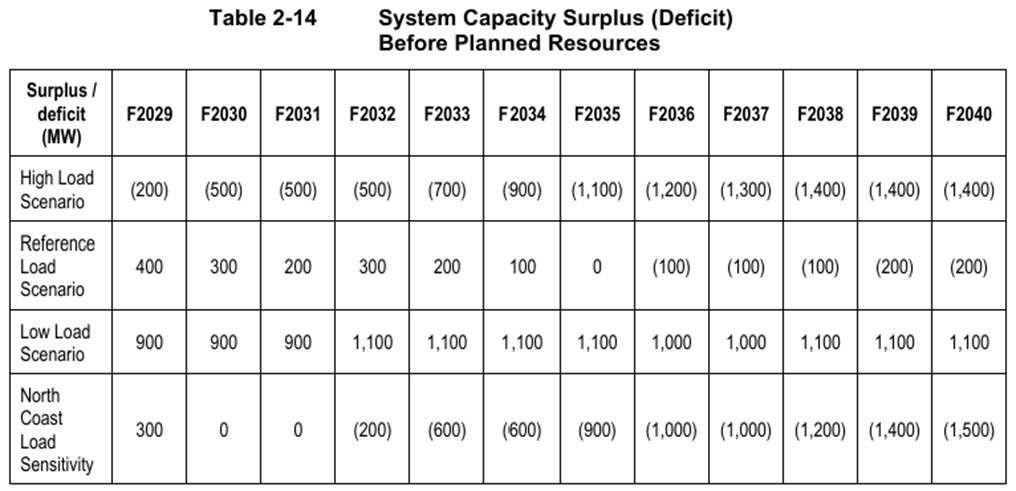

While the energy position has improved since the April 2023 estimate, the capacity (or peak demand) forecast has worsened – it is now showing a small deficit by F2036. This could get considerably worse in the High Load Scenario or with more demand from the North Coast:

There are transmission constraints in three of BC Hydro’s major regions: South Coast, Vancouver Island and North Coast. The most “pronounced” constraint is the North Coast, which BC Hydro claims could have a 900 MW deficit by F2040 (for context, Site C provides about 1,100 MW of capacity).

And the plan is?

BC Hydro plans to address the Reference Scenario with the following portfolio of activities:

- Spend more on energy efficiency programs and incentives for customer solar generation;

- Acquire 5,000 GWh of new energy by F2034;

- Add a sixth generating unit at Revelstoke Generating Station for 500 MW of capacity; and

- Build the North Coast Transmission Line.

The additional 5,000 GWh of new energy will probably come mostly from onshore wind, and possibly some utility-scale solar farms. BC Hydro won’t know what’s on offer until it receives the bids from its 2025 Call for Power, which are due January 5, 2026.

But this “plan” would only be sufficient to provide the demand in the Reference Scenario, which doesn’t include electricity for the LNG and mining companies on the North Coast, fuel-switching to meet the government’s legislated climate targets, or future data centres and artificial intelligence businesses.

Measured against the BCUC’s planning guidelines, BC Hydro’s efforts are woefully deficient. The Plan should provide portfolios for the High Load and North Coast Scenarios too, should they come to pass.

The planning guidelines also say there should be multiple portfolios for each scenario, so we can see the trade-offs between them. BC Hydro didn’t even provide multiple portfolios for the Reference Scenario, it simply provided a comparison of different choices for each category, such as the level of investment in energy efficiency programs.

Conclusion

Utilities face “asymmetric risk” – in other words, the danger of running out of electricity is worse than having too much of it. Starting work now to prepare for capacity shortfalls a decade out makes sense, and the plan to ramp down the energy efficiency spending if it isn’t needed could reduce any unnecessary overspending.

But BC Hydro’s Plan is simply not adequate to ensure it can keep the lights on if this, or some future government, decides to get serious about meeting climate targets, or allowing the high-tech sectors of the economy to grow.

BC Hydro suggested that the BCUC review process might be completed in as few as eight months. Let’s hope that’s enough time to develop a more credible plan than BC Hydro has presented.