The drought caused BC Hydro to import $1.4 billion-worth of electricity last year. Profits from Powerex, its energy trading subsidiary, will subsidize the additional cost for now, but we should consider improving our electricity self-sufficiency.

Quite the turnaround

According to a recent report filed with the BCUC, BC Hydro spent $1,377.5 million on electricity imports in the 2023/24 (F2024) year which ended on March 31. This was the main driver behind its cost of energy soaring to $3.2 billion compared to a budget of $1.9 billion.

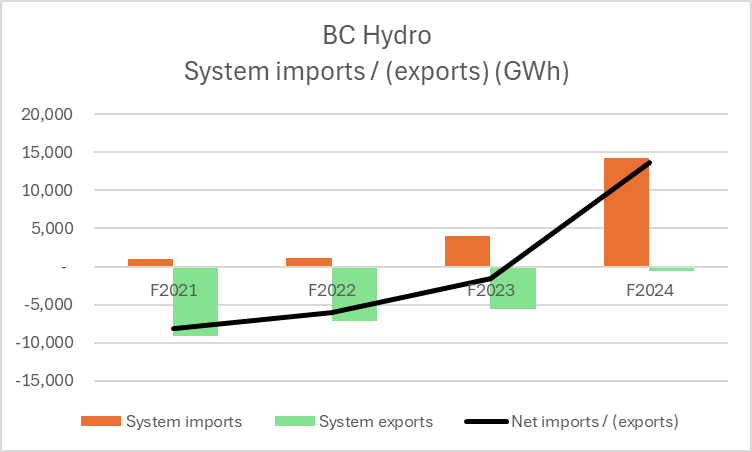

It is the first time in at least four years that the utility has had to rely on net imports of energy.

This is almost entirely due to the province’s current drought. BC Hydro generated 12,648 gigawatt hours (GWh) less of its own electricity than planned last year, a drop of 28 percent. It also purchased 2,336 GWh less from independent power producers. Instead of planned net exports of 1,074 GWh, BC Hydro ended up with net imports of 13,603 GWh (14,216 GWh of imports, less 613 GWh of exports).

Ratepayers are on the hook for the extra cost of the electricity imports, although this won’t show up until April 1, 2025 because rates for last year and this year were set based on a lower forecast cost of energy and there is no adjustment mechanism.

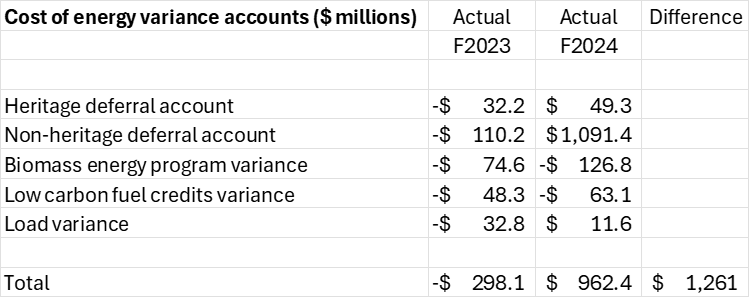

In the meantime, the overspending is recorded in BC Hydro’s cost of energy variance accounts. Since the previous year the balance in these accounts has swung from BC Hydro owing ratepayers $298 million to ratepayers owing BC Hydro $962 million, a swing of $1,261 million, almost all related to the energy imports.

(Note: in prior years the deferral account rate rider also incorporated the balance of the trade income variance account; this is no longer the case.)

Powerex to the rescue

Fortunately for BC Hydro’s ratepayers, salvation is at hand. The BC government subsidizes the cost of their electricity with the profits from Powerex, BC Hydro’s energy trading subsidiary.

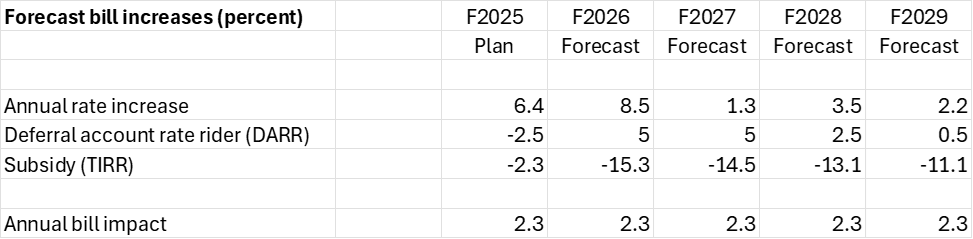

BC Hydro forecast in October 2023 that customers’ bills would only rise 2.3 percent a year until F2029. The subsidy, which shows up on bills as the TIRR, or Trade Income Rate Rider, offsets the effect of the extra spending on energy, which shows up as the Deferral Account Rate Rider, or DARR. The subsidy is also sufficient to moderate the effect of rising electricity rates, which are expected to go up 8.5 percent in F2026, largely because of the additional costs of the Site C dam coming into service.

This subsidy is not granted to ratepayers of other electricity utilities, such as FortisBC Inc. One might argue this is discriminatory, since Powerex is a provincially owned asset whose benefits should be shared by all the province’s ratepayers, although the government might retort that lower BC Hydro rates flow through to these other utilities, who buy its electricity.

Regardless, without the subsidy BC Hydro customers would have been facing bill increases of up to 15 percent a year for the next four years.

I suspect, though, that BC Hydro’s October 2023 forecast was a little too rosy.

The drought probably had a larger effect last year than was anticipated at the time, and it has continued into the current year. I’ll explore this in more detail in a future article. For now, let’s just say that I’ll be surprised if the deferral account rate rider drops below 5 percent (the maximum rate allowed by the approved formula) in F2028, as the current forecast suggests.

Conclusion

It appears that the ratepayer impact of the energy imports has been mitigated, for now at least. But I think we should take the idea of electricity self-sufficiency more seriously.

Section 6 of the Clean Energy Act requires BC Hydro to be self-sufficient, which you might think would be protection enough. But in 2012 this requirement was watered down (sorry, I couldn’t resist) in a special direction to the BCUC so that it only applies in “average water conditions.”

This really doesn’t provide a lot of comfort – as we are now seeing, BC Hydro is not self-sufficient in below-average water conditions. If we’re serious about electricity self-sufficiency, it might be wise to consider whether BC Hydro should be self-sufficient even in lower-than-average water years.

Another loophole is that BC Hydro only needs to consider its “mid-level forecast” when calculating whether it will be self-sufficient in future. The problem here is that BC Hydro’s current mid-level forecast (known as the reference scenario in its most recent long-term resource plan) doesn’t include the electricity required to meet the government’s greenhouse gas (GHG) emission reduction goals, let alone the additional demand from new LNG and mining facilities. If BC Hydro had included that demand in the mid-level forecast, it would have been clear that it won’t meet even the legal self-sufficiency requirement.

A higher degree of self-sufficiency would come at a cost, to be sure, but energy security has a value of its own. And it’s even possible that locally generated electricity might be cheaper than imports. A crude estimate of BC Hydro’s cost of last year’s imported energy is $97 / MWh ($1,377.5 million / 14,216 GWh system imports). In its 2021 Integrated Resource Plan, BC Hydro estimated that it could acquire up to 10,000 GWh of onshore wind for less than $60 / MWh.

A good place to examine this question would be BC Hydro’s next long-term resource plan, due to be filed October 31, 2025.